Business Insurance in and around Glasgow

Calling all small business owners of Glasgow!

Almost 100 years of helping small businesses

Business Insurance At A Great Price!

Whether you own a a photography business, a home cleaning service, or a fabric store, State Farm has small business protection that can help. That way, amid all the different moving pieces and options, you can focus on navigating the ups and downs of being a business owner.

Calling all small business owners of Glasgow!

Almost 100 years of helping small businesses

Small Business Insurance You Can Count On

You are dedicated to your small business like State Farm is dedicated to fantastic insurance. That's why it only makes sense to check out their coverage offerings for surety and fidelity bonds, worker’s compensation or commercial auto.

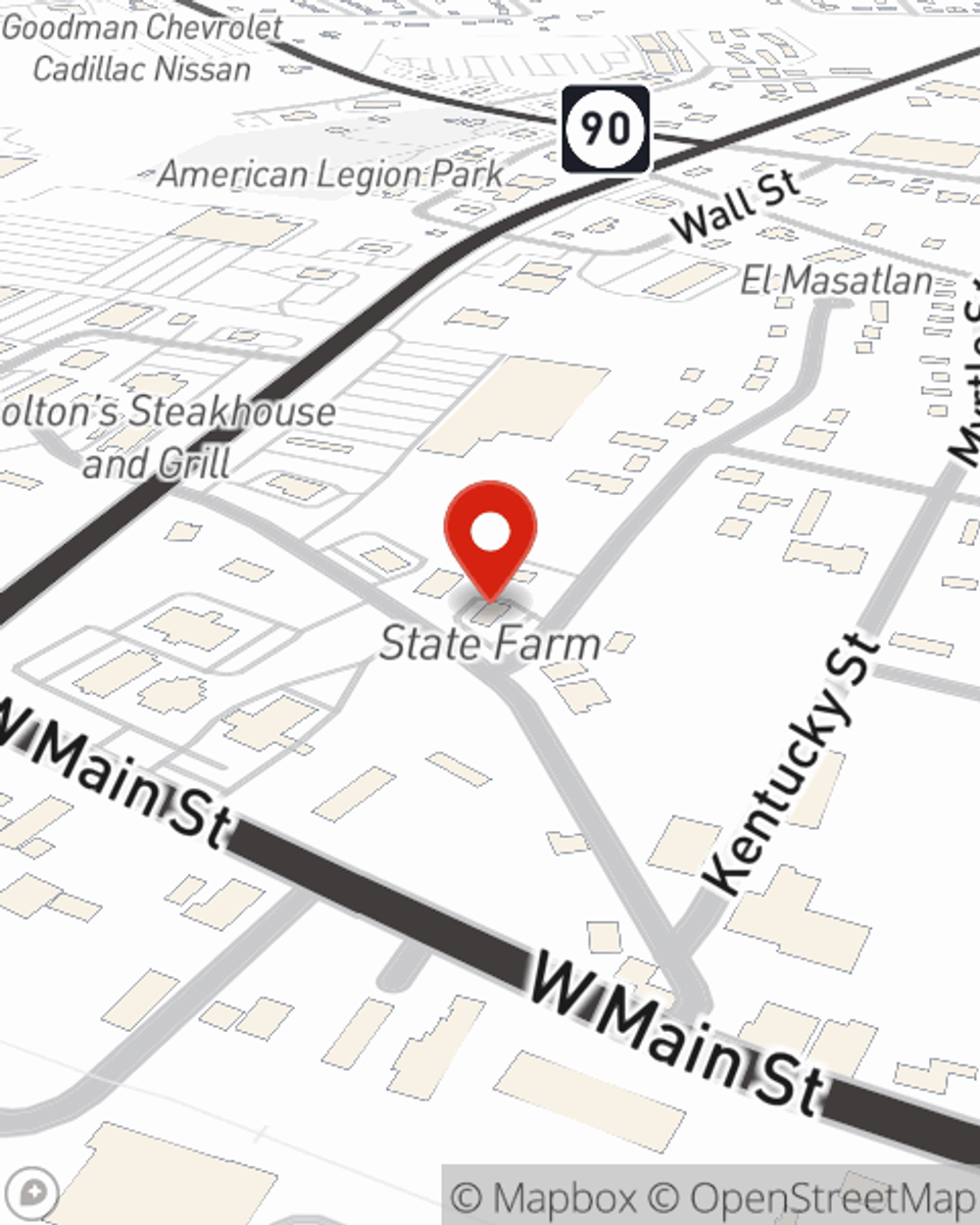

As a small business owner as well, agent Jason Miller understands that there is a lot on your plate. Visit Jason Miller today to chat about your options.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Jason Miller

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.